You find the perfect pair of sneakers or the headset you have been longing for while browsing online. However, while placing the order you realise your bank account isn’t ready to make the purchase. Then, you wonder if there is an app that allows you to buy now and pay later without the stress of expensive purchases. Tabby App in the UAE is the solution to enhance your shopping experience.

Tabby UAE offers the option of “buy now, pay later” to customers in the UAE. This allows them to make purchases without paying the full amount upfront, and without high interest rates. Moreover, customers can buy their favourite merchandise without their credit cards. Merchants are protected through credit risk checks, late fees, and measures against defaulting customers.

Read more: eCommerce Website Design

An Overview of the Tabby App UAE

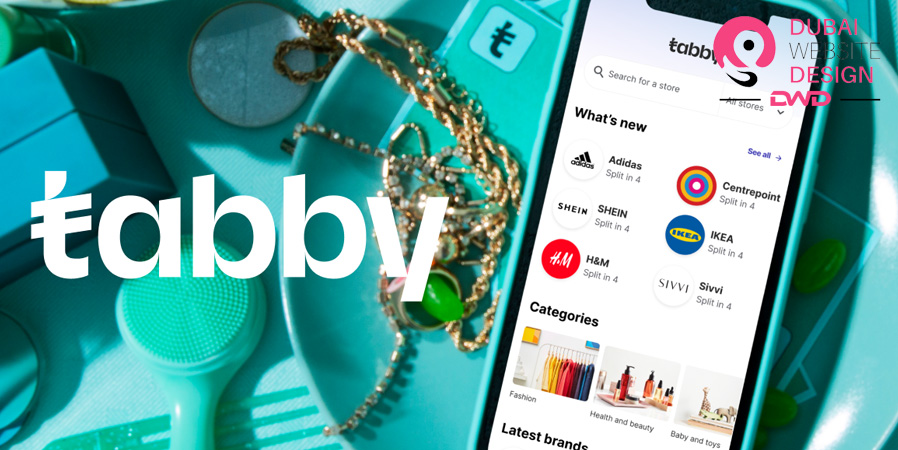

Tabby stands out as a popular buy now, pay later (BNPL) service in the United Arab Emirates. You can use it to split your purchases into smaller, more manageable payments. This app lets you shop at your favourite stores without paying the full amount upfront. Tabby partners with many well-known brands across the UAE. It provides you with lots of shopping options. You can find Tabby both online and in physical stores.

The app is free to download, and it’s super easy to use. With it, you can manage your spending and keep track of your payments in one place. Tabby’s goal? To make shopping easier and more budget-friendly for people in the UAE. It lets you buy what you need now and spread out the cost over time. It’s a flexible, modern take on shopping that’s become really popular in the UAE.

How Does it Work?

Tabby’s “Buy Now, Pay Later” (BNPL) system is simple. When you’re checking out at a store that partners with Tabby, you’ll see the option to pay with it. You can then split your purchase into four equal payments. The first one is due at checkout, and the other three are spaced out over the next three months.

Tabby doesn’t charge any interest on your payments. You simply pay the cost of your item, split into four parts. To get started, you’ll need to create an account and link a payment method, whether it’s a credit card, debit card, or even your bank account.

Tabby App does a quick eligibility check, and once you’re approved, you’re good to go. The app helps you stay on top of things by tracking your payments and sending you reminders when they’re due. You can also check your payment schedule anytime and even pay early if you’d like.

Perks of Using Tabby in the UAE

Shopping in the UAE may be expensive. This is particularly true when you’re looking for luxury gadgets and accessories. But with Tabby, you don’t have to worry about saving enough money, which is why Tabby has rapidly become a favourite among frequent shoppers. The benefits of using Tabby while shopping in the UAE are listed below:

Flexible Shopping Options

With Tabby App, you can shop at many stores across the UAE. The app works with both online and physical retailers. You’re not limited to just a few places. This wide range of options lets you use Tabby for all kinds of purchases. From clothes to electronics, you can find what you need and pay over time.

Interest-Free Payments

Tabby offers interest-free payments on all purchases. You pay the same price as you would if you bought the item outright. This perk helps you manage your budget without extra costs. You can spread out big purchases over time without paying more. This feature makes expensive items more accessible and helps you avoid credit card debt.

No Hidden Fees

Tabby prides itself on transparency. There are no hidden fees or charges when you use the service. You only pay for your purchase, split into four parts. This clear pricing helps you plan your budget without surprises. You know right from the start that what exactly what you’ll pay. This openness builds trust and makes financial planning easier.

Easy-to-Use App

Tabby’s app is user-friendly and packed with features. You can track your purchases, view payment schedules, and manage your account. The app sends payment reminders to help you stay on top of your dues. You can also see available credit and browse partner stores. This ease of use makes shopping and budgeting simpler.

Quick Approval Process

Tabby’s approval process is fast and easy. You can get approved to use the service in minutes. This quick process lets you start shopping right away. You don’t have to wait days for approval like with some credit cards. This speed is handy when you need to make a purchase quickly.

Plentiful Choices

Tabby has collaborated with a diverse range of retailers to guarantee that there is something for everyone. You may be interested in fashion, technology, home décor, or beauty items. Tabby offers a smooth shopping experience with worldwide brands and local favourites.

Safe & Secure

Shop with confidence knowing that your transactions are safeguarded by cutting-edge industry security procedures. If you’re not satisfied with your purchase, you can return it and receive a refund immediately through the Tabby app.

Impact of the Tabby App on Shopping

Tabby has revolutionised retail in the UAE and beyond with its flexible, interest-free payment option. Whether you’re purchasing electronics or searching for the perfect gift, Tabby enables stress-free shopping.

But Tabby’s impact extends beyond consumers. Retailers are also reaping the benefits with increased sales and a growing customer base. By partnering with Tabby, businesses can offer an enticing payment option, converting casual browsers into paying customers and expanding their clientele.

Tabby offers a fresh way to shop in the UAE. This BNPL service lets you buy what you need now and pay over time. You can use Tabby at many stores, both online and in-person. The app is easy to use and doesn’t charge interest or hidden fees. You can split your purchases into four payments, making budgeting easier. Tabby’s quick approval process lets you start shopping right away.

The app helps you track your payments and manage your spending. With Tabby UAE, you can make larger purchases without straining your budget. This service gives you more control over your shopping and finances. As BNPL services grow in popularity, Tabby stands out as a top choice in the UAE. It offers a balance of convenience, flexibility, and transparency. If you’re looking for a new way to shop, Tabby might be worth trying. Contact us for Website Design Solutions.